A common soil-based, plant-fungus relationship that helps plants feed and develop resilience against drought, infection, and disease. It is potentially a good carbon sink. Myco does best in no-till, undisturbed soil and is generally depleted/not present in areas where industrialized farming is prominent. It can be bought dried and powdered and added to soil to promote growth, restoration - and is sometimes hombrewed in commercial quantities. There are many types, and certain strains are best suited for certain plants.

It’s a symbiotic relationship between a fungus and a plant. Two types of mycorrhizal fungi are commonly used as soil amendments - endomycorrhiza (AKA “endo” or arbuscular) and ectomycorrhiza (AKA ecto). Both more or less take carbon and sugar in exchange for funneling minerals and water to the plant. It is natually occuring but is usually depleted in heavily-tilled areas.

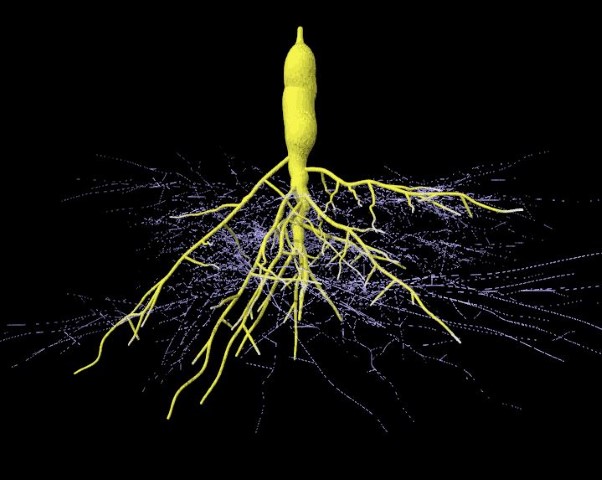

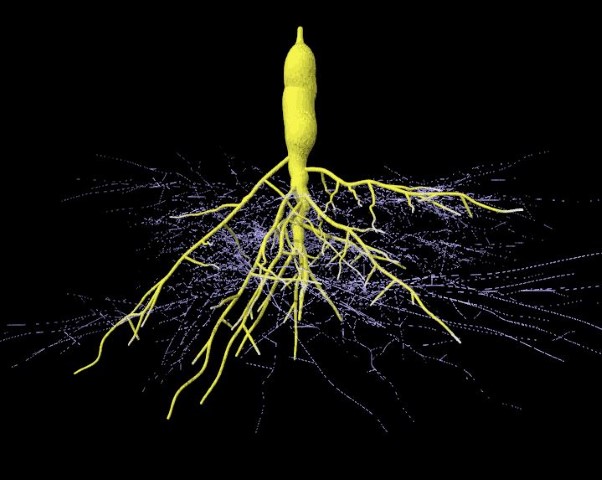

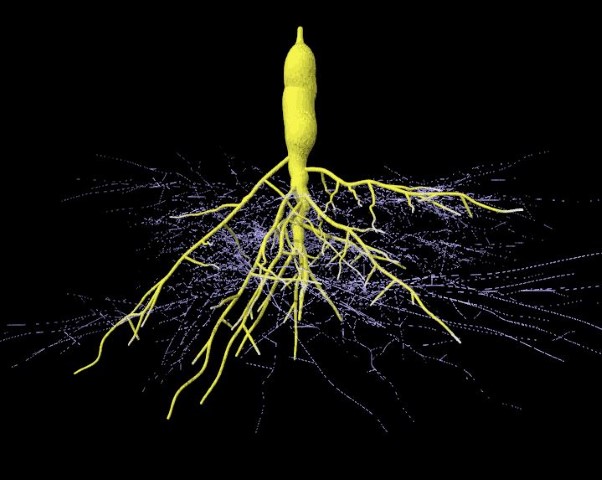

Endo forms a penetrative bond with plant roots and takes in carbon / sugar from the plant in exchange for funneling the plant water and minerals in the soil and its surroundings - especially phosphorus. Endo species come from one Phylum, and are found in nearly 85% of plant species.

The latter (ecto) is found in ~2% of plant species - typically the roots of trees and more “woody” plants. Unlike endo, ecto does not penetrate the plant’s cell walls. The exchange is more or less the same, however the dense intercellular interface between the fungi and plant roots can also help it to survive adverse events (drought, wind, etc). Notable, Ecto may be a much better carbon sink than endo:

Ectomycorrhizal fungi are better able to take up nitrogen in the soil, and plants that associate with this type (known as ECM plants) can take advantage of higher carbon dioxide levels even when nitrogen is low, whereas plants associated with arbuscular mycorrhizal fungi (known as AM plants) cannot.

Here is a comprehensive list of the mycorrhizal fungi associated to specific plants. The “more or less” list of what doesn’t appear to benefit from purely mycorrhizal fungi is important to remember:

In total, mycorrhizal fungi benefit 80 to 90 percent of all plant species. Plants that do not respond to mycorrhizae include azalea, beet, blueberry, broccoli, brussels sprouts, cabbage/kale, carnation, cauliflower, collards, cranberry, heath, huckleberry, mustard, protea, rhododendron, sedge and spinach.

In a pepper test, I mentioned that I wanted to use great white because of it contained Trichoderma harzianum and Trichoderma koningii which might help keep my dehydrated food waste soil amendment in check. Such combinations are not uncommon - and mycorrhizal fungi play especially well with Trichoderma and many species of bacteria.

The market is fragmented but plants provide a consistent user base! Kidding, but seriously.

Mycorrhizae is commonly found in living or hot soils marketed to growers interested in organics or no-till. Some “far-hobbyist” growers make large quantities of it for their own use, as referenced above.

Africa, restorative, exploratory - industrialized use in the US is minimal but could rise for reasons mentioned below.

At scale in the US there are a handful of companies focused on the tradiontal Ag market that are moving into what the 2018 Farm Bill defined as “biostimulants,” which include beneficial fungi. The Regulatory framework for this corner of the market is in-progress, as is a shift in the competitve landscape toward adoption by “majors.” Two current examples are:

Formed by Sumitomo after acquiring Abbott’s ag division, Valent Biosciences acquired Mycorrhizal Applications LLC with the intention of building out a “biorational window” for sustainably grown crops. Valent Sustainable Solutions measures their offerings as “sustainable” and marks whether they’re OMRI or CDFA organic input as well.

In 2016 Farmers Business Network Launched a sales channel “FBN Direct” for direct ordering of inputs. There are several listings for mycorrhizae products from vendors like Valent and Helena, however none appear to be currently available.

More recently, FBN announced the launch of Biological solutions on that platform. The soil probiotics appear to be single-strain / bacterial at a significantly higher concentration (CFU/g) than are present in hobbyist offerings. Aside from a lack of myco - the carbon biologicals appear to be “leonardite” based, which is a topic I’ll cover when looking into Biochar. Notable, all of the Biologicals listed are made by a single company, Generic Crop Science., which recently acquitred established player Wilowood USA.

It is possible that entrants into this market will have ties to the petro / mining industries and are seeking to generate carbon offset credits while keeping them within their supply chain. An example of this is the Sumitomo/Valent acquisition of Mycorrhizal Applications in 2015.

TBD